Q: Larry asks, “It seems like I can find all the information on what I need if I itemize but a nice simple list on what I need if I don’t itemize seems to be harder to come by. Any thoughts?”

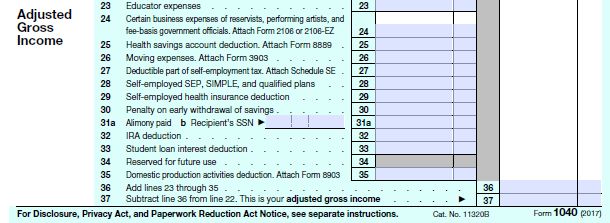

A: Good question and there are opportunities for you “non-itemizers”. Typically we refer to these as above the line deductions. That’s because these deductions reduce adjusted gross income (AGI), which is used as a qualifier for many deductions and credits… The things you want to think about here are:

- Educator expenses. An eligible educator can deduct up to $250 of unreimbursed trade or business expenses – $500 if married and both are educators.

- HSA contributions. By you, not your employer. Often individuals want to deduct what the employer contributed on the employees behalf – don’t do it. These are typically pre-tax already.

- Moving expenses. If you meet certain requirements, you can deduct moving expenses. There are minimum distance and minimum employment durations, so ask your CPA after relaying the specifics of your situation.

- Alimony.

- Traditional IRA contribution. Roth contributions are post-tax and NOT deductible.

- Student loan interest.

Self-employed deductions are more suited for another topic, however, a couple are worth noting as they are above the line tax deductions.

- Self-employment (SE) tax deduction. Typically this is an automatically calculated feature in most software. The reporting of SE income would trigger the deduction.

- Self-employed health insurance. I see many self-employed individuals miss out on this deduction. There are some caveats that must be met to be eligible to claim, but this is definitely worth bouncing off your CPA.

More significant opportunities for non-itemizers are opportunities for credits. Some of these are:

- Child tax credit

- Earned income credit

- Education Credit (AOTC & LLC)

- Foreign tax credit

- Health insurance credit

- Qualified solar electric and heating credit

- Retirement savings contributions credit.

If you think you may qualify for some of these, share the specifics of your circumstances with your CPA.

Hope this helps! Feel free to reach out to me personally to discuss the particulars – jcrutcher@nashtax.com.

Helps tremendously, Josh. I really appreciate it. Thanks so much.