On Thursday, February 4, all organizers for past clients were uploaded to the client portal. So why so late this year?

The IRS is not currently accepting returns and will not begin accepting until February 12th. Typically, the IRS begins accepting returns mid to late January… But now organizers have been loaded to the portal and you can begin pulling your tax documents together…

For new clients, I have included a blank tax organizer at the link below:

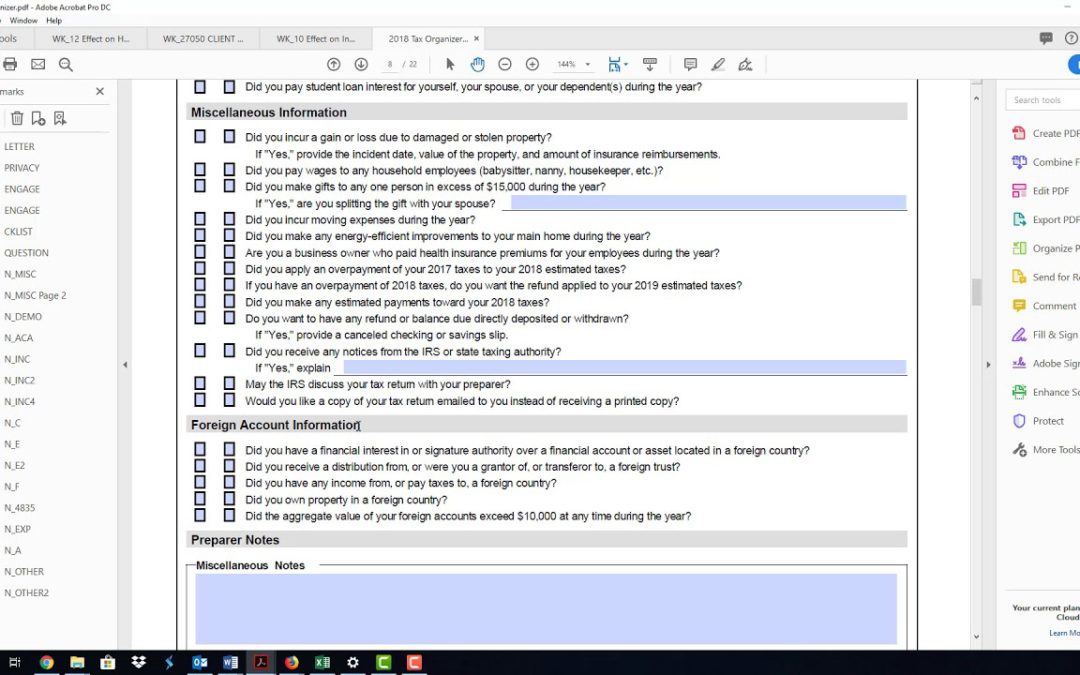

Below is a quick refresher on completing the tax organizer.

I wanted to touch on a few high-level items that may speed up your completion of the tax organizer. I have created a quick 3-minute video to hit items at a high level. Essentially we are focusing on the following:

- Complete ALL the yes/no questions. These are helpful in identifying opportunities OR additional compliance requirements.

- If you are providing W-2’s, 1099-B’s, 1099-DIV’s, etc. – you only need to submit the forms. No need to spend time keying that in the organizer as well.

- Sign the engagement letter.

- If you are unsure of something, put together a list of questions and go ahead and upload the document. We can discuss down the road.

If you have any questions, just reach out at jcrutcher@nashtax.com.