From the Nashville Tax Blog

Why you will love your kids even more this tax season!

The child tax credit changes are HUGE for my clients with children. Many have historically been phased of out being able to claim the credit. However, this year most will be able to take advantage. I give you a brief summary of the changes and highlight...

2019 Tax Calendar

January 15 — Individuals Make a payment of your estimated tax for 2018 if you did not pay your income tax for the year through withholding (or did not pay in enough tax that way). Use Form 1040-ES January 31 — All Employers Give your employees their...

Tax Q&A: Deductions for Non-Itemizers

Q: Larry asks, "It seems like I can find all the information on what I need if I itemize but a nice simple list on what I need if I don't itemize seems to be harder to come by. Any thoughts?" A: Good question and there are opportunities for you “non-itemizers”. ...

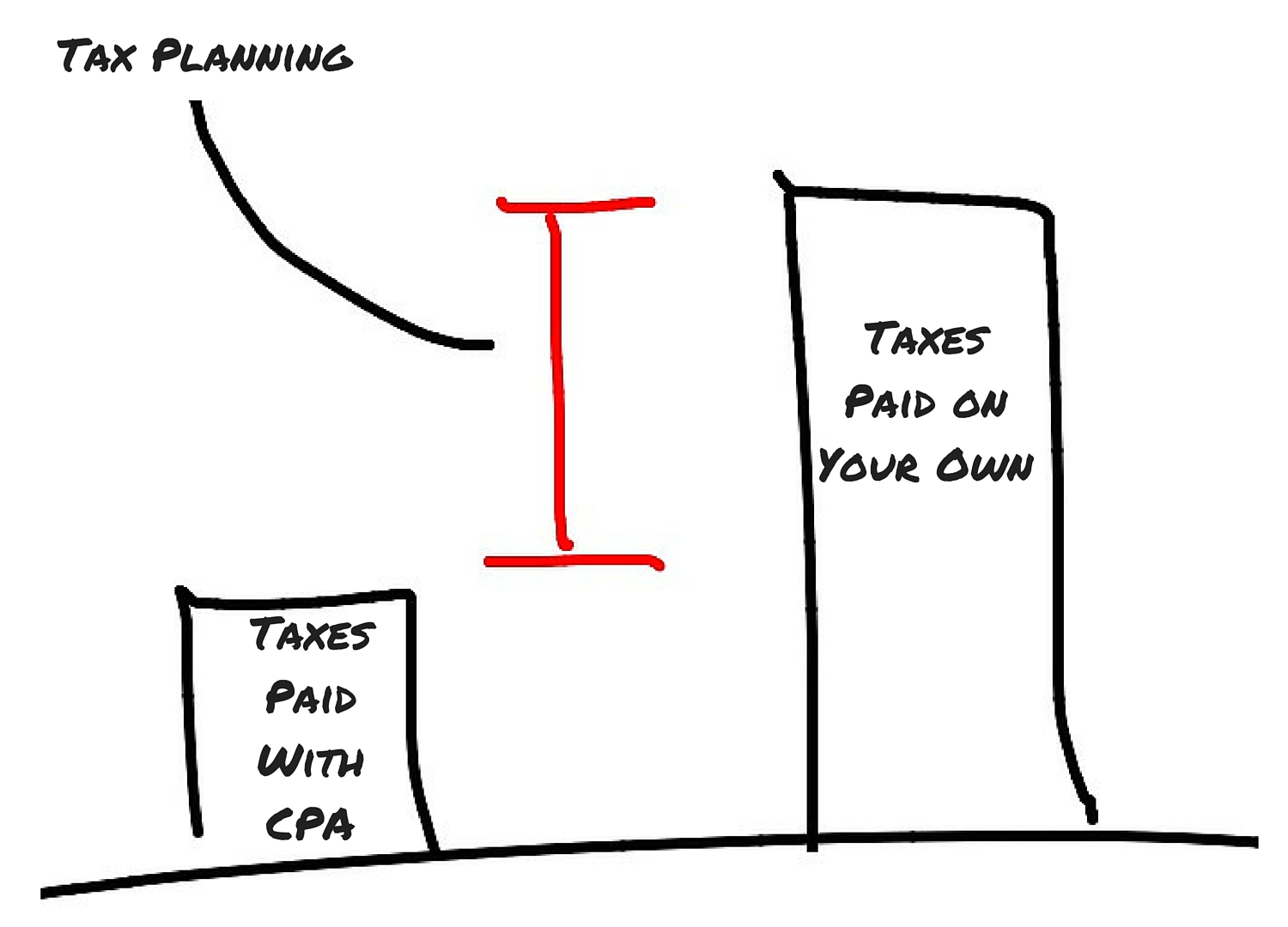

How I Am Different

We are available to sit down and accessible virtually, we have a high-tech tax portal and financial planning platform available to you, and offer meaningful, down to earth discussions about your finances.

Flexible

I understand you are busy. That’s why we can meet in person or have virtual meetings while you are on the go.

Technology

Our financial planning technology is state of the art – access your financial information in one place, anytime, and anywhere.

Straightforward

Fee-only fiduciary. No selling products. Just helping you learn and grow. That means your success is my top priority.

I have several questions for you:

- Does the thought of meeting with a tax CPA give you anxiety?

- Does the very thought of taxes make you feel uneasy, concerned, or stressed out?

- Does thinking about gathering your information at the end of the year make you cringe?

- Are you a bit nervous whether your business it set up correctly with the state and the IRS?

- Do you want to gain control of your personal and business finances but are unsure how to do so and whether you are “doing it right”?

Organize and Simplify.

Business owners have many more planning opportunities (ahem… tax saving opportunities) than typical employees. Please call me to discuss and ensure you aren’t leaving anything on the table.