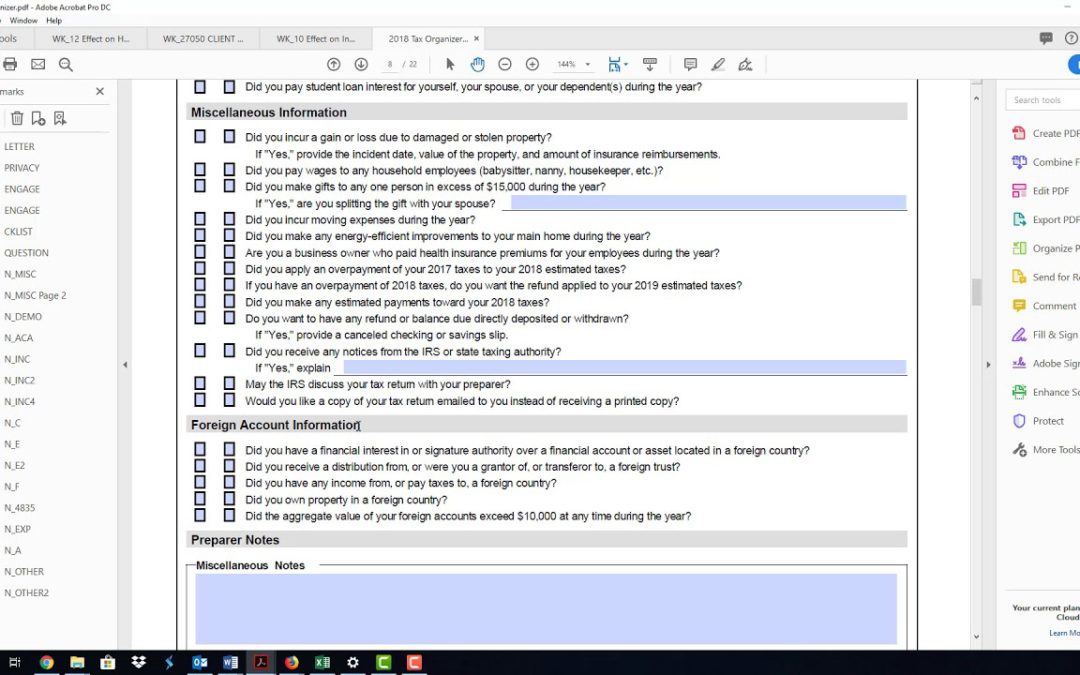

by Joshua B Crutcher, CPA | Feb 4, 2021 | Business Planning, Entity Planning, Individual and Family Planning, Tax Services, Taxes

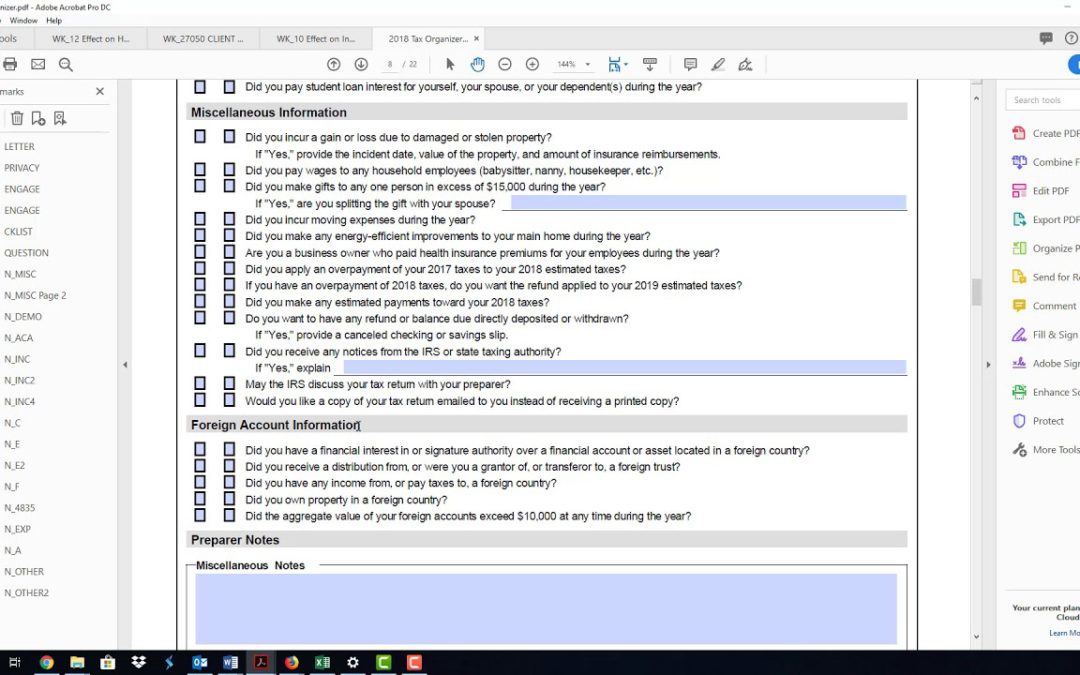

On Thursday, February 4, all organizers for past clients were uploaded to the client portal. So why so late this year?The IRS is not currently accepting returns and will not begin accepting until February 12th. Typically, the IRS begins accepting returns mid to late...

by Joshua B Crutcher, CPA | Feb 4, 2021 | Accounting, Business Planning, Entity Planning, Individual and Family Planning, Tax Services, Taxes

You may be involved in a “second business” that might almost be thought of as a “hobby.” Activities that involve an element of personal enrichment or recreation are magnets for IRS scrutiny. This does not necessarily mean that you cannot deduct...

by Joshua B Crutcher, CPA | Feb 3, 2021 | Business Planning, Tax Services, Taxes

February 1Businesses: Provide Form 1098, Form 1099-MISC (except for those that have a February 16 deadline), Form 1099-NEC and Form W-2G toEmployers: Provide 2020 Form W-2 to Report income tax withholding and FICA taxes for fourth quarter 2020 (Form 941). File an...

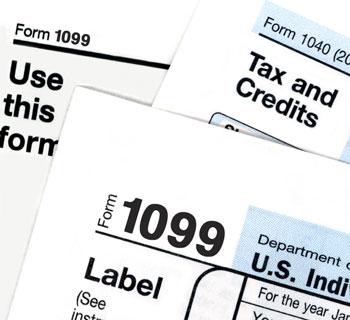

by Joshua B Crutcher, CPA | Feb 7, 2019 | Business Planning, Tax Services, Taxes

January 15 — Individuals Make a payment of your estimated tax for 2018 if you did not pay your income tax for the year through withholding (or did not pay in enough tax that way). Use Form 1040-ES January 31 — All Employers Give your employees their copies of Form W2...

by Joshua B Crutcher, CPA | Dec 4, 2016 | Business Planning, Taxes

One of the most sweeping changes from last year are the 1099 due date changes. These must be filed with the IRS by January 31, 2017. Previously, we have had to get them to recipients by January 31, to the IRS by February 28th if paper filing, or by March 31st if...

by Joshua B Crutcher, CPA | Dec 2, 2016 | Business Planning, Taxes

In a logical move by the IRS, due dates are actually going to flow in a much logical order in 2017. For my clients, the important items to note are the following: If you file 1099’s or have W-2 employees, these are due to the recipient on January 31. Previously, the...