by Joshua B Crutcher, CPA | Jan 20, 2023 | Individual and Family Planning, Tax Services, Taxes

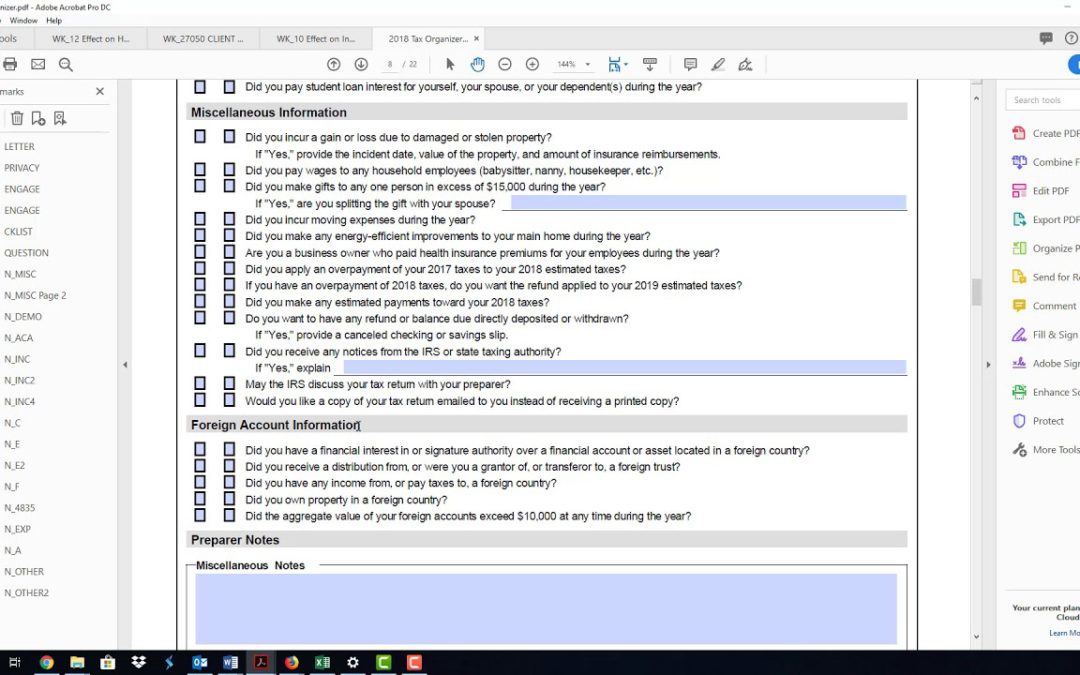

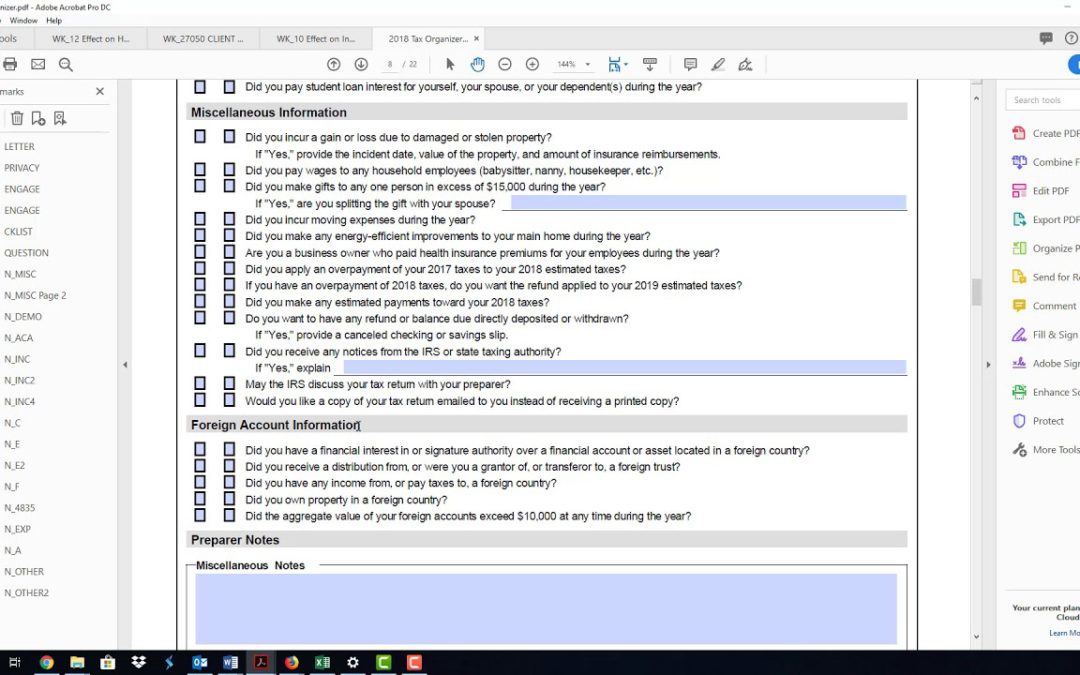

On January 20th, we sent an email with our traditional PDF organizer and also provided access to our online organizer… Of course, we only need one organizer completed. We chose offer you an option for your preference: Our traditional PDF organizer (see...

by Joshua B Crutcher, CPA | Jan 20, 2023 | Individual and Family Planning, Tax Services, Taxes

On January 20th, all organizers for past clients were uploaded to the client portal. The IRS is will begin accepting returns on January 23rd. For new clients, I have included a blank tax organizer at the link below: 2022 Tax Organizer Below is a quick refresher on...

by Joshua B Crutcher, CPA | Feb 4, 2021 | Business Planning, Entity Planning, Individual and Family Planning, Tax Services, Taxes

On Thursday, February 4, all organizers for past clients were uploaded to the client portal. So why so late this year?The IRS is not currently accepting returns and will not begin accepting until February 12th. Typically, the IRS begins accepting returns mid to late...

by Joshua B Crutcher, CPA | Feb 4, 2021 | Accounting, Business Planning, Entity Planning, Individual and Family Planning, Tax Services, Taxes

You may be involved in a “second business” that might almost be thought of as a “hobby.” Activities that involve an element of personal enrichment or recreation are magnets for IRS scrutiny. This does not necessarily mean that you cannot deduct...

by Joshua B Crutcher, CPA | Feb 4, 2021 | Individual and Family Planning, Taxes

Businesses generally can deduct the entire cost of operating a vehicle for business purposes. Alternatively, they can use the business standard mileage rate, subject to some exceptions. The deduction is calculated by multiplying the standard mileage rate by the number...

by Joshua B Crutcher, CPA | Feb 3, 2021 | Business Planning, Tax Services, Taxes

February 1Businesses: Provide Form 1098, Form 1099-MISC (except for those that have a February 16 deadline), Form 1099-NEC and Form W-2G toEmployers: Provide 2020 Form W-2 to Report income tax withholding and FICA taxes for fourth quarter 2020 (Form 941). File an...

by Joshua B Crutcher, CPA | Apr 10, 2020 | Coronavirus Videos, Taxes

by Joshua B Crutcher, CPA | Apr 9, 2020 | Coronavirus, Taxes

The U.S. SBA has recognized Tennessee as a declared state for Coronavirus (COVID-19) disaster assistance. If your business has been impacted, you can now apply at no cost for a disaster assistance loan.For eligible small businesses, churches and non-profits who have...

by Joshua B Crutcher, CPA | Apr 8, 2020 | Coronavirus Videos, Taxes

by Joshua B Crutcher, CPA | Apr 8, 2020 | Coronavirus, Taxes

We hope that you are keeping yourself, your loved ones, and your community safe from COVID-19 (commonly referred to as the Coronavirus). Along with those paramount health concerns, you may be wondering about some of the recent tax changes meant to help everyone coping...

by Joshua B Crutcher, CPA | Apr 8, 2020 | Coronavirus Videos, Taxes

by Joshua B Crutcher, CPA | Apr 8, 2020 | Coronavirus Videos, Taxes