Summary

Let’s start with the basics:

- When are 1099’s due? January 31,2020

- What do I need if my business paid independent contractors?

- Form W-9 to be completed by those contractors

- The total amount paid to those contractors if $600 or more

Here is a downloadable excel file you can use to summarize your 1099’s and submit to me via your the online portal.

About 1099-MISC

So you are seeing colleagues post questions about 1099’s. Does this apply to you? Do you have any action items? Well, let’s see! This 1099 guide pertains strictly to the self-employed, those working side hustles, and those who hire out independent contractors. In other words, this applies to:

- Freelancers

- Contractors

- MLM’s

- Self-Employed

- Photographers

- Developers

- Bloggers

- Sole Proprietor’s

- Musicians

Why the emphasis? There are many forms of 1099’s:

- You will receive one for your dividends – 1099-DIV.

- You will receive one for your interest – 1099-INT.

- You may receive one for retirement distributions – 1099-R.

- There are many others…

- We are focusing on the 1099-MISC.

Start from Scratch – What is a 1099? A 1099-MISC is an informational return reporting payments to contractors for services provided. These are necessary to be filed to track payments for multiple reasons:

- To report income of the contractors you have used.

- To justify an expense for paying the contractors you used.

Did you hire your buddy Johnny to build your $3,000 website? You need to 1099 him. You played fifty music gigs downtown Nashville this year. You made $50k. You have paid your band $25,000. Have you 1099’d them? If not, you may be on the hook for the entire $50k. You sub out part of your job? Tile work on a home contract? Design work on a website? 1099 the subcontractors.

The Education is Beginning to Build… Tell Me More

So now you are starting to get an idea of what a 1099 is, let’s discuss a common issue – are you or is your contractor an employee or independent contractor?

Let’s back up a bit… If you were to start work with McDonald’s, a manufacturing gig at Nissan, an engineering 9-5 with a local firm, or an accounting gig at a local CPA firm – these guys are going to give you a W-2. You are in their employ working as an employee. What does this mean exactly?

As an employee, your employer is required to withhold taxes from your paycheck and send them to the IRS on your behalf. This keeps you from having to fork over $10k, $25k, or $100k in a lump sum at the end of the year.

On the other hand, independent contractors do not have any taxes withheld. If you pay a painter $3,000 to paint your house, you pay them $3,000 – not $2,341.79 after withholding federal, Social Security, or Medicare taxes. Get the picture?

Briefly, if your “employer” set the hours, provides the tools, has ultimate control over “the work” to be done – most likely you are an employee and should be receiving a W-2 where taxes are being withheld from your paycheck.

If you provide your own tools, set your own hours, and have ultimate control over when and how you work then you are most likely a 1099 independent contractor.

So why harp on employee classification? Two reasons: (1) the IRS was beginning to place more emphasis on this pre-Trump and (2) post-Trump tax policies with make accurate enforcement of employee classification a prominent issue due to the additional 20% QBI pass through deduction.

I’m giving you the brief version. If you want several chapters, set up an appointment by emailing me at [email protected].

OK, IT’S IMPORTANT! I Get it! Do I need to file?

There are only a couple numbers you need to think about – $10 and $600. 99% of the population will only need to think of $600. But, if you paid the following:

- At least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest;

- At least $600 in:

- rents;

- services performed by someone who is not your employee;

- prizes and awards;

- other income payments;

- medical and health care payments;

- crop insurance proceeds;

- cash payments for fish (or other aquatic life) you purchase from anyone engaged in the trade or business of catching fish;

- generally, the cash paid from a notional principal contract to an individual, partnership, or estate;

- payments to an attorney; or

- any fishing boat proceeds,

…Then a 1099-MISC should be issued.

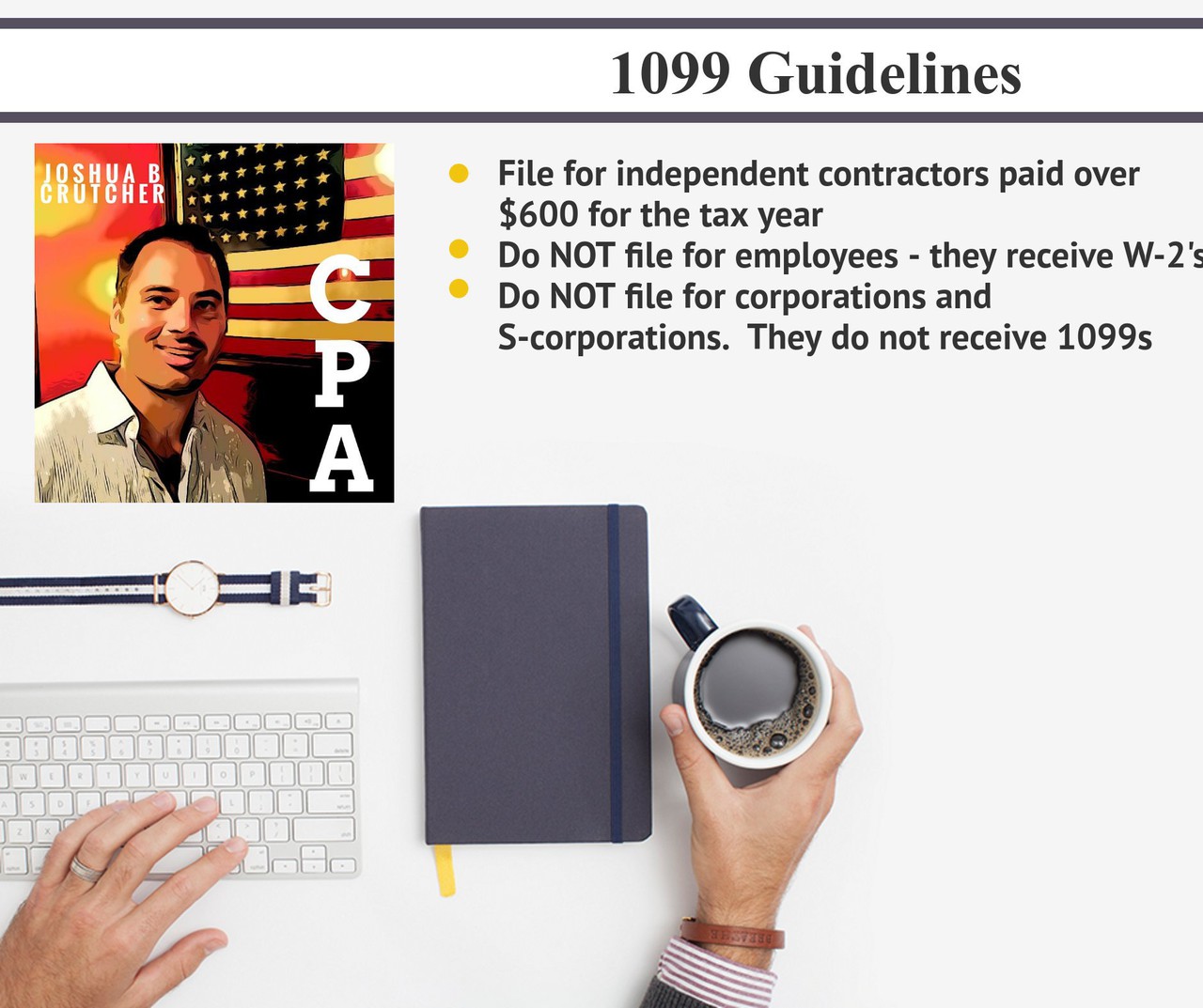

There are exceptions – C-Corporations do not need to be issued a 1099.

So, you paid $600 to a contractor. What now? It’s time for you to get your contractor information together. You will need bits of information for each contractor along with how much you paid them. You need the following:

- Contractor Legal Name

- Social Security Number or EIN

- Contractor address

- Contractor email

- Amount paid to contractor

The IRS has a form W-9 that should be sent to contractor and returned each year – sometimes contractors move and addresses need to be updated. I also have an excel template to track the information in as well. I HIGHLY RECOMMEND you allow your tax preparer to file these 1099’s on your behalf. If you have an accounting staff, then they may have the expertise to responsibly file these for you. Why? Because a good CPA will guide you through the process, educate you along the way, guide you in preparing what is needed, and E-File on your behalf. It keeps the process smooth and painless… Last thing you need to know – when are these due? JANUARY 31, 2020 To recap:

- If you paid a contractor over $600, you need to file a 1099

- You need to contract the contractor and request them to complete form W-9

- Complete the excel file summary with each contractors information and how much was paid

- Send to your CPA (clients upload to my client portal)

- CPA will e-file with IRS and get copies to your clients

Any questions? Please use me as a tax resource as I am here to help you!