2017 Planning for the Tax Cuts and Jobs Act (TCJA)

We have will have a new law in effect January 1, 2018. This is the largest tax reform in thirty years, which will take some time to digest and develop solid planning strategies into the future. However, we do know some things we can do between now and year end…

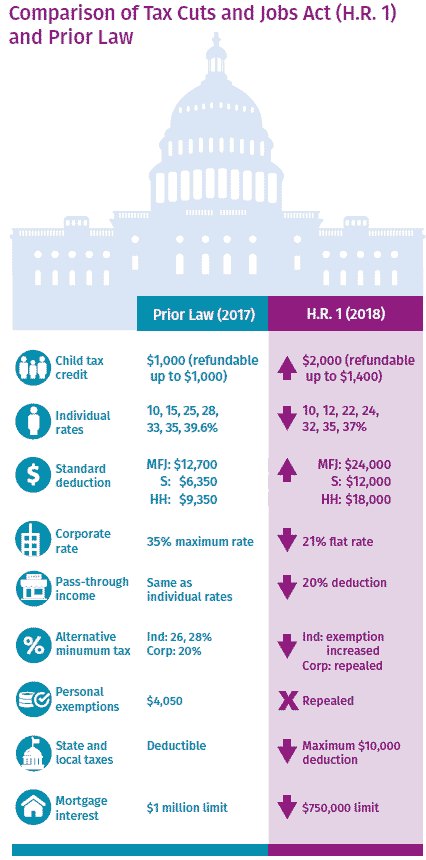

Let’s begin with some general observations from the Tax Cuts and Jobs Act (TCJA):

- About 80% of households will get a tax cut with 5% paying more and the remaining 15% paying the same.

- The standard deduction nearly doubled and personal exemptions were nixed and should be considered together. For a couple with no children, the standard deduction of $6,350 each and personal exemption of $4,050 yielded $21,800 of benefit. The new standard deduction for a married couple is $24,000.

- Small businesses – sole proprietors, partnerships, and S-corporations – are to benefit from the 20% pass-through deduction.

- C-corporation tax rates will be a flat 21%.

- There is simplification for some, but more complexity for others. It will take months to unravel planning strategies from the revisions.

Stay posted for more details on the Act. This tax bill remains complex. For now, turn your focus on what can be done between now and year-end to put yourself in a more favorable position.

Here are some action items to consider for individuals:

- If you have received you property tax assessment, have yet to pay it, and itemize – consider paying it before year-end. State and local tax deductions will be capped at $10,000 beginning in 2018.

- If you itemize and plan on making charitable contributions, go ahead and these prior to year-end as they will likely yield more benefit to you in 2017 than 2018.

- Consider paying down your home equity line of credit. The interest deduction in respect to HELOC’s is suspended as of January 1,2018. At the same time, if you have been considering taking out a HELOC – reconsider.

- If you currently meet the 10% of AGI limit for deductible medical expenses, it may be worthwhile to fit in other appointments between now and year-end.

Here are action items for business owners:

- If you are reporting on the cash basis, hold off on billing clients to ensure income is received in 2018 where rates will be more favorable.

- If you have any client entertainment planned, work that in to 2017 as the 50% deduction for these expenses is NOT included in the new law effective January 1, 2018. Note that taxpayers may still generally deduct 50% of the portion pertaining to food and beverages.

- If you have an S-Corporation in Tennessee, consider deferring paying out any year-end distributions until 2018.

Keep in mind that everyone’s tax situation is different! Please call or email me with any questions you have specific to your tax situation.

Much more to come! Talk soon!