From the Nashville Tax Blog

1099’s Due to IRS by January 31

One of the most sweeping changes from last year are the 1099 due date changes. These must be filed with the IRS by January 31, 2017. Previously, we have had to get them to recipients by January 31, to the IRS by February 28th if paper filing, or by March 31st if...

Tax Due Date Changes for the 2017 Filing Season (12/31/2016 Year-End)

In a logical move by the IRS, due dates are actually going to flow in a much logical order in 2017. For my clients, the important items to note are the following: If you file 1099’s or have W-2 employees, these are due to the recipient on January 31. Previously, the...

Free Tax Filing

Look, as a CPA, I work with a lot of small businesses and prepare returns that have some complexity. These are my typical clients. But not everyone needs that level of detailed CPA work. If you only have a W-2, you can easily file online for free! For those of you...

How I Am Different

We are available to sit down and accessible virtually, we have a high-tech tax portal and financial planning platform available to you, and offer meaningful, down to earth discussions about your finances.

Flexible

I understand you are busy. That’s why we can meet in person or have virtual meetings while you are on the go.

Technology

Our financial planning technology is state of the art – access your financial information in one place, anytime, and anywhere.

Straightforward

Fee-only fiduciary. No selling products. Just helping you learn and grow. That means your success is my top priority.

I have several questions for you:

- Does the thought of meeting with a tax CPA give you anxiety?

- Does the very thought of taxes make you feel uneasy, concerned, or stressed out?

- Does thinking about gathering your information at the end of the year make you cringe?

- Are you a bit nervous whether your business it set up correctly with the state and the IRS?

- Do you want to gain control of your personal and business finances but are unsure how to do so and whether you are “doing it right”?

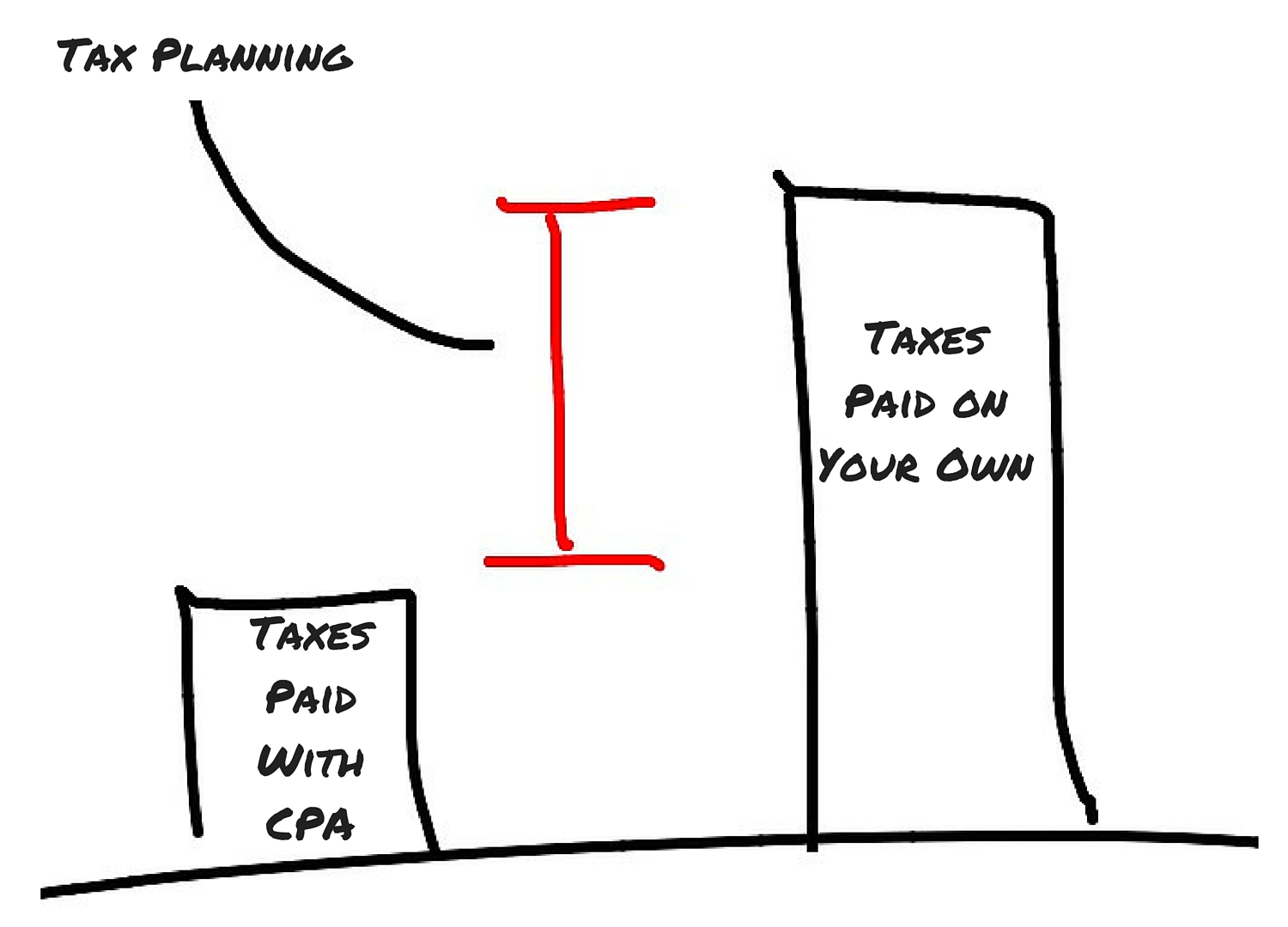

Organize and Simplify.

Business owners have many more planning opportunities (ahem… tax saving opportunities) than typical employees. Please call me to discuss and ensure you aren’t leaving anything on the table.