From the Nashville Tax Blog

2020 Tax Calendar

2020 Calendar Year Due DatesFirst Quarter Due DatesThe first quarter of a calendar year is made up of January, February, and March.January 10:Employees who work for tips. If you received $20 or more in tips during December, report them to your employer....

UPDATED – 1099 Filing Guide For Business Owners

SummaryLet's start with the basics:When are 1099's due? January 31,2020What do I need if my business paid independent contractors?Form W-9 to be completed by those contractorsThe total amount paid to those contractors if $600 or moreHere is a downloadable excel file...

UPDATED – 2019 Tax Organizer

On Saturday, January 11, all organizers for past clients were uploaded to the client portal. For new clients, I have included a blank tax organizer at the link below:2019 Tax OrganizerBelow is a quick refresher on completing the tax organizer. I wanted to...

How I Am Different

We are available to sit down and accessible virtually, we have a high-tech tax portal and financial planning platform available to you, and offer meaningful, down to earth discussions about your finances.

Flexible

I understand you are busy. That’s why we can meet in person or have virtual meetings while you are on the go.

Technology

Our financial planning technology is state of the art – access your financial information in one place, anytime, and anywhere.

Straightforward

Fee-only fiduciary. No selling products. Just helping you learn and grow. That means your success is my top priority.

I have several questions for you:

- Does the thought of meeting with a tax CPA give you anxiety?

- Does the very thought of taxes make you feel uneasy, concerned, or stressed out?

- Does thinking about gathering your information at the end of the year make you cringe?

- Are you a bit nervous whether your business it set up correctly with the state and the IRS?

- Do you want to gain control of your personal and business finances but are unsure how to do so and whether you are “doing it right”?

Organize and Simplify.

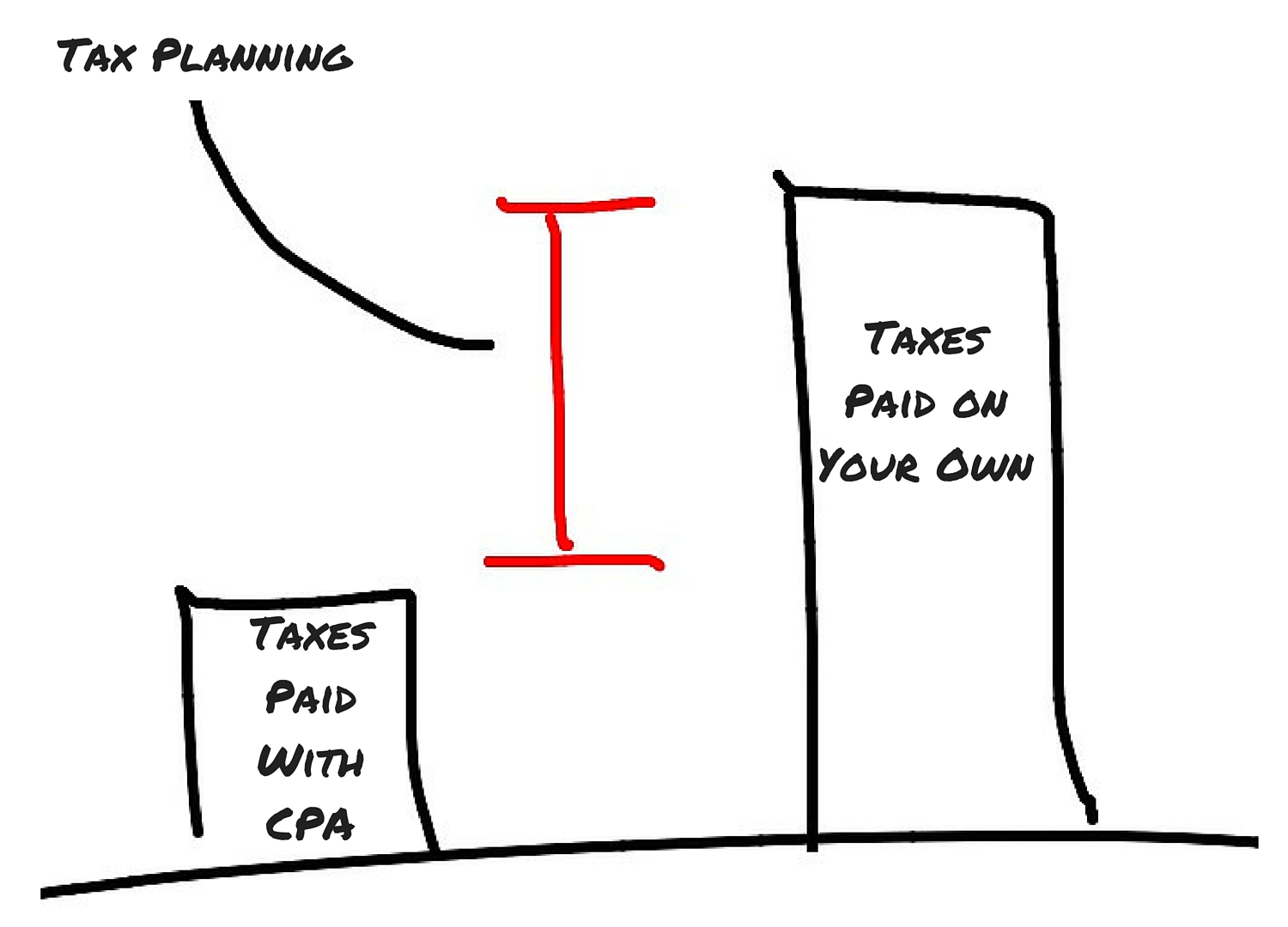

Business owners have many more planning opportunities (ahem… tax saving opportunities) than typical employees. Please call me to discuss and ensure you aren’t leaving anything on the table.