From the Nashville Tax Blog

Overview of Relief Available to Small Businesses During the COVID-19 Pandemic

We have put together a quick summary of resources available to small businesses amid the coronavirus (COVID-19) pandemic and hope that you will find it useful. This memo will guide you through the primary relief options available to small businesses...

Coronavirus – Student Loan Relief

On March 20, 2020, the Department of Education announced terms for student loan relief for tens of millions of borrowers in response to COVID-19.1 Here are answers to some questions about the new rules. For more information and to follow subsequent...

IRS Announces 2020 Standard Mileage Rates

TAX TIP: Business owners claiming mileage, please go ahead and take a picture of your odometer now. This represents some proof of mileage in addition to oil change receipts and your mileage logs.Effective January 1, 2020, the standard mileage rates are...

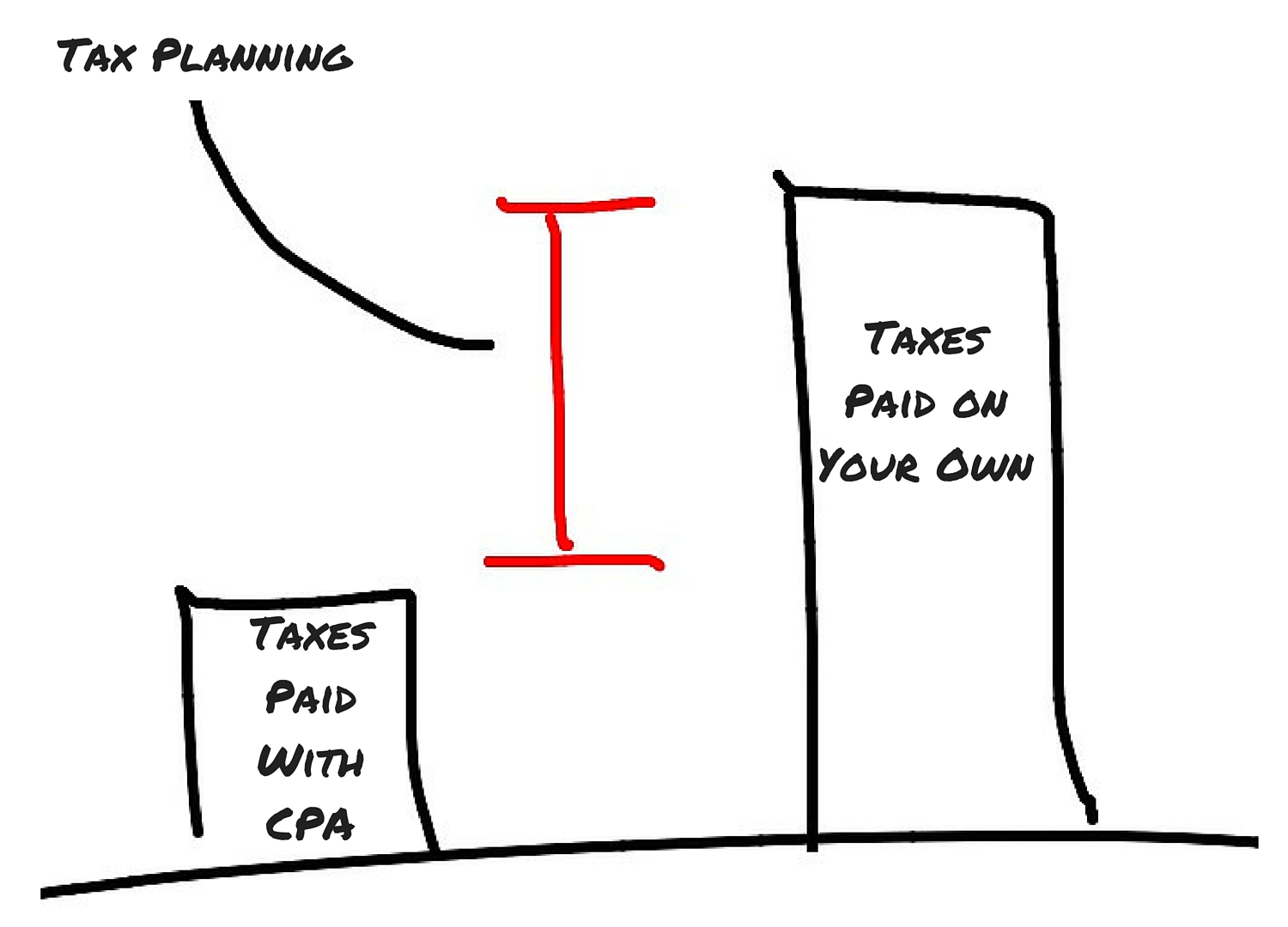

How I Am Different

We are available to sit down and accessible virtually, we have a high-tech tax portal and financial planning platform available to you, and offer meaningful, down to earth discussions about your finances.

Flexible

I understand you are busy. That’s why we can meet in person or have virtual meetings while you are on the go.

Technology

Our financial planning technology is state of the art – access your financial information in one place, anytime, and anywhere.

Straightforward

Fee-only fiduciary. No selling products. Just helping you learn and grow. That means your success is my top priority.

I have several questions for you:

- Does the thought of meeting with a tax CPA give you anxiety?

- Does the very thought of taxes make you feel uneasy, concerned, or stressed out?

- Does thinking about gathering your information at the end of the year make you cringe?

- Are you a bit nervous whether your business it set up correctly with the state and the IRS?

- Do you want to gain control of your personal and business finances but are unsure how to do so and whether you are “doing it right”?

Organize and Simplify.

Business owners have many more planning opportunities (ahem… tax saving opportunities) than typical employees. Please call me to discuss and ensure you aren’t leaving anything on the table.