From the Nashville Tax Blog

Business or Hobby – Be Careful!

You may be involved in a "second business" that might almost be thought of as a "hobby." Activities that involve an element of personal enrichment or recreation are magnets for IRS scrutiny. This does not necessarily mean that you cannot deduct expenses...

2021 Mileage Rates – Down to $0.56 per Mile

Businesses generally can deduct the entire cost of operating a vehicle for business purposes. Alternatively, they can use the business standard mileage rate, subject to some exceptions. The deduction is calculated by multiplying the standard mileage rate...

2021 Tax Calendar

February 1Businesses: Provide Form 1098, Form 1099-MISC (except for those that have a February 16 deadline), Form 1099-NEC and Form W-2G toEmployers: Provide 2020 Form W-2 to Report income tax withholding and FICA taxes for fourth quarter 2020 (Form 941)....

How I Am Different

We are available to sit down and accessible virtually, we have a high-tech tax portal and financial planning platform available to you, and offer meaningful, down to earth discussions about your finances.

Flexible

I understand you are busy. That’s why we can meet in person or have virtual meetings while you are on the go.

Technology

Our financial planning technology is state of the art – access your financial information in one place, anytime, and anywhere.

Straightforward

Fee-only fiduciary. No selling products. Just helping you learn and grow. That means your success is my top priority.

I have several questions for you:

- Does the thought of meeting with a tax CPA give you anxiety?

- Does the very thought of taxes make you feel uneasy, concerned, or stressed out?

- Does thinking about gathering your information at the end of the year make you cringe?

- Are you a bit nervous whether your business it set up correctly with the state and the IRS?

- Do you want to gain control of your personal and business finances but are unsure how to do so and whether you are “doing it right”?

Organize and Simplify.

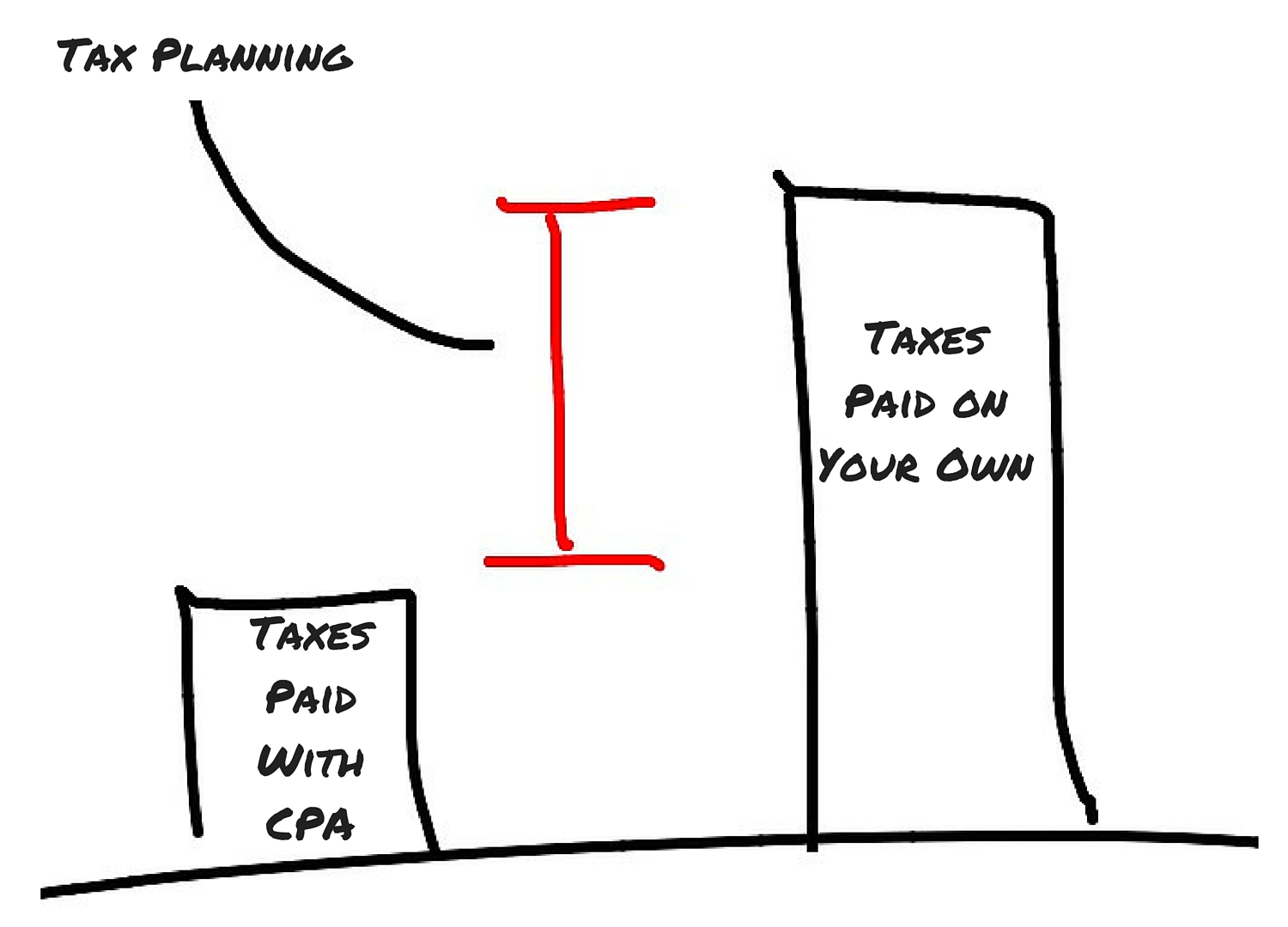

Business owners have many more planning opportunities (ahem… tax saving opportunities) than typical employees. Please call me to discuss and ensure you aren’t leaving anything on the table.